Hedging future fixed-rate debt

Summary

Organizations can take advantage of the current rate environment to reassess their interest rate exposure. Locking in rates on future fixed-rate debt issuances can be particularly advantageous because of the heightened volatility in yields and substantial global uncertainty around geopolitics and central bank interest rate policy.

(Updated 3-10-25)

As companies take a fresh look at capital structure plans for the future, including refinancing or issuing new bonds, many are considering hedging the future risk of their new coupon. The volatility in the interest rate markets and ongoing uncertainty regarding future geopolitics, economic stability, and inflation is causing many corporations to consider hedging risk on medium and long-term rates.

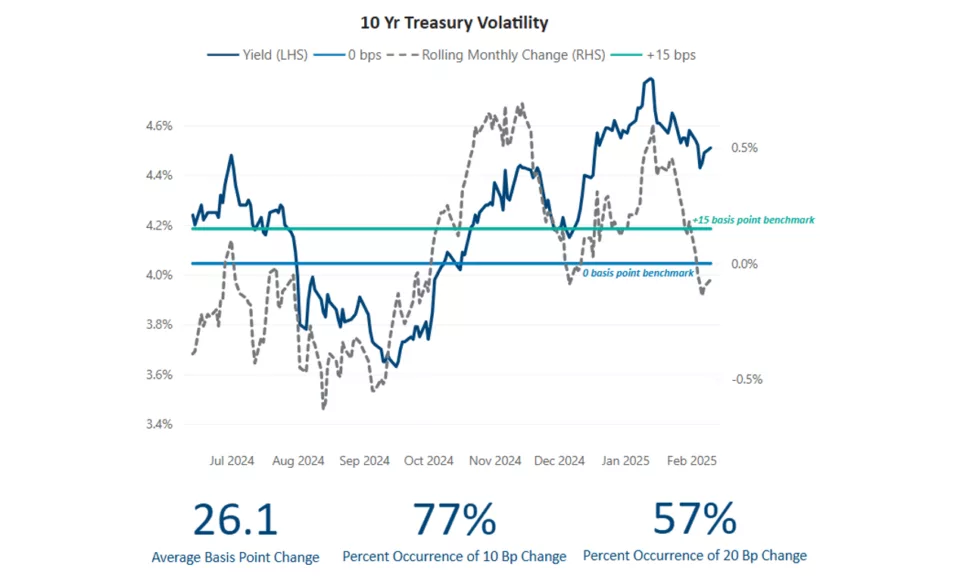

As shown in the graphic below, there has been heightened interest rate volatility within the U.S. treasury market in 2025. When looking at all rolling 30-day periods over the last 12 months, 57% of the time yields moved by at least 20 basis points. Likewise, the average basis point change was 26.1 over a one-month period. For companies looking to issue fixed-rate debt, there is potential for significant movement in the fixed-rate coupon that will be locked in upon issuance if remaining unhedged. The analysis and graphic below also suggest it is never too late to hedge an upcoming fixed-rate debt issuance, since substantial risk remains even over a one-month time period.

The recent elevated volatility has created interest from many firms to lock in rates on future fixed-rate debt issuances today. Companies pursuing this strategy should be prepared to navigate the complexities of trade structure, accounting, and market pricing for this approach.

While some companies issue floating-rate debt routinely with standard hedging practices in place, many find themselves exploring the topic of pre-issuance hedging infrequently. The process includes many parallels to hedging shorter-term floating rate debt, but it contains a few meaningful differences that your organization should be aware of before hedging.

Mechanics matter

While hedges of future fixed-rate issuances and term loan debt typically include pay-fixed structures, debt issuance product selections, and hedge structures include a few meaningful differences. The first is that the debt issuance will typically price over Treasuries. This introduces a product choice trade-off between a Treasury Lock that is a closer match to the underlying exposure, and a cash-settled forward-starting swap that introduces swap spread risk but offers greater flexibility and pricing efficiency. Other structure considerations can impact credit, pricing, and risk reduction.

Credit dynamics

Forward hedging instruments are designed to be cash-settled upon issuance of the debt instrument. Even though the ultimate maturity of the hedge will align with the future debt maturity, the bank’s exposure to corporate credit is limited to the mandatory cash settlement date, which aligns with debt issuance rather than maturity. This reduces credit exposure and should reduce credit charges accordingly.

Pricing sensitivity

Despite the shorter credit exposure horizon, the underlying hedge instrument will typically have a longer-dated maturity than a hedge of term or revolver debt. This can drive a materially larger dollar value of each basis point on the rate, increasing sensitivity to pricing efficiency. Transparency into live market pricing as well as any trading, liquidity, and/or credit charges is especially important when the value of even a fraction of a basis point is material. This sensitivity is compounded by the fact that forward hedging requires not one, but two pricing exercises, including both the initial trade execution as well as the termination pricing upon debt issuance.

Effectiveness

Unlike term debt, there is typically some level of uncertainty around the future debt instrument, particularly with respect to tenor and issuance date. Mismatches between the hedge structure and the eventual debt will impact both the economic and accounting effectiveness of the hedge. Both can be evaluated prior to hedging in order to structure the trade economics and accounting designation approach appropriately to maximize effectiveness.

Index considerations

If hedging a future fixed-rate issuance with swaps (as opposed to Treasury locks), your organization will enter into a swap where you pay a fixed rate and receive SOFR, the trade being cash-settled upon issuance of the fixed-rate debt. Standard market convention is to structure the swap with annual interest periods, indexed to SOFR compounded in arrears with no lookback and a 2-day payment delay. Although, specific terms can be customized based on the company’s preference.

As your organization continues to evaluate future debt issuances and seek hedging for longer horizons, you will need to navigate the complexities of forward hedging. Chatham provides access to leading practices related to trade structure and accounting as well as market pricing to ensure an efficient and effective hedge.

Chatham Financial treasury advisory

Chatham Financial partners with finance teams to develop and execute capital market strategies that align with organizational objectives. Our full range of solutions includes capital advisory, financial risk management strategy development, risk quantification, exposure management (interest rate, currency, and commodity), outsourced execution, technology solutions, and hedge accounting. We work with finance and treasury teams to develop, evaluate, and enhance their risk management programs and to articulate the costs and benefits of strategic decisions.

Subscribe to receive our market insights and webinar invites

Disclaimers

Chatham Hedging Advisors, LLC (CHA) is a subsidiary of Chatham Financial Corp. and provides hedge advisory, accounting and execution services related to swap transactions in the United States. CHA is registered with the Commodity Futures Trading Commission (CFTC) as a commodity trading advisor and is a member of the National Futures Association (NFA); however, neither the CFTC nor the NFA have passed upon the merits of participating in any advisory services offered by CHA. For further information, please visit chathamfinancial.com/legal-notices.

25-0025