Managing FX risk in a volatile market

Summary

FX volatility poses a growing challenge for treasury and financial teams in today's increasingly unpredictable global landscape. Geopolitical tensions, tariff turmoil, shifting central bank policies, and inflationary pressures are driving currency fluctuations across markets. These fluctuations can affect cash flow, earnings, and overall financial stability, making it essential to monitor FX risk proactively and implement effective strategies to manage exposure. In this article, we explore six key questions to answer when navigating currency volatility in a market where uncertainty has become the new normal.

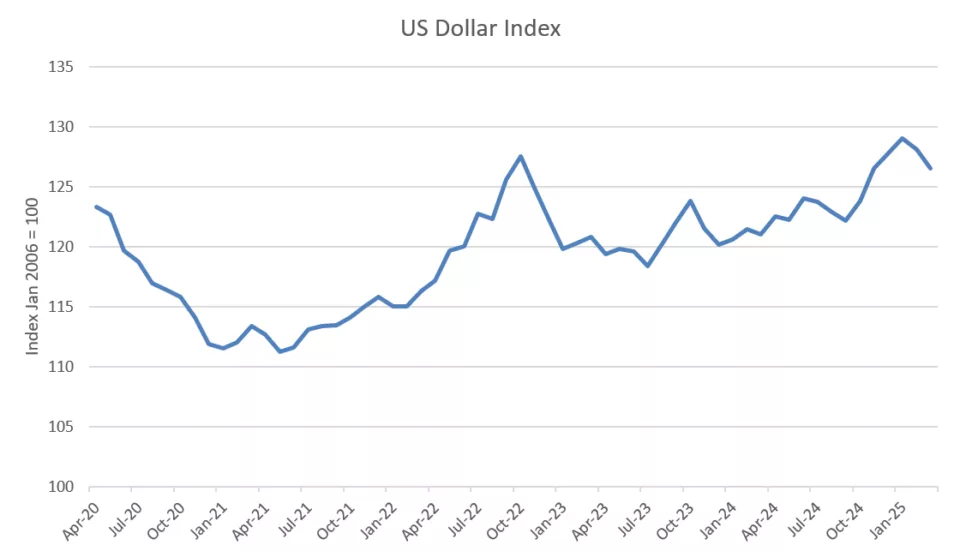

Source: FRED

Consider the following six questions as you navigate the currency markets and protect your bottom line.

1. How much flexibility do we have to make strategic adjustments?

In a volatile environment, you should first seek to understand the company’s overall exposure and FX risk profile. Even companies with robust hedging can feel significant impacts of sharp currency movements, which can be amplified by policies that leave little room for strategic decision-making. Ensuring your FX policy provides sufficient flexibility to quickly adjust tactics (including target hedge ratios, instruments, and duration) based on changing market dynamics is key to running a world-class hedging program.

2. Should we hedge our FX risk?

If you don’t currently manage your foreign currency exposures, the financial headwinds created by currency volatility may prompt you to consider hedging. Rather than executing hedges as a knee-jerk reaction, use this wake-up call as an opportunity to develop a robust, thoughtful strategy that can benefit your organization long term. Consider fundamental questions, such as "Should we be hedging?", “How should we be hedging?”, and “Where does hedging fit in our overall activities?” A thoughtful approach to answering these questions leads to a more resilient and effective strategy that can adapt as your business evolves.

3. Should we add a cash-flow FX hedging strategy?

If you maintain balance-sheet hedging, you may want to consider adding cash-flow hedging to address fundamental mismatches between revenues and expenses brought on by currency fluctuations. These impacts can be especially painful because they are reported under gross margin, which appears higher in the income statement than other income and expenses. Because it's difficult to forecast costs and revenue, especially in a foreign currency, implementing these strategies can be challenging. However, when well executed, they can deliver significant benefits, such as adding certainty to your forecasted revenue and expense and avoiding wide swings in earnings.

4. What is driving FX gain or loss?

It is important to determine which FX risk variables you can control through hedging and which levers to pull in various market conditions. Having a firm understanding of what is driving FX gain/loss is key to managing balance sheet risk appropriately; this becomes even more critical during times of high market volatility. Many treasury groups are implementing technology solutions that identify key drivers of FX gain/loss in a matter of minutes, providing on-demand insight into variables such as forward point cost, hedge timing mismatches, over/under hedging, and spot slippage.

5. How effectively are we mitigating FX risk?

Even longstanding FX hedging programs may require reassessment in today’s volatile market. Changes such as M&A, spin-offs, evolving business priorities, or shifts in risk tolerance can alter your risk profile. External factors like the competitive landscape or internal changes such as automation initiatives or staff turnover might also impact program objectives. A comprehensive review can help identify strategic adjustments to enhance performance or reduce costs. Some key areas to review include:

Program performance and insights

Treasury teams face increasing pressure to deliver real-time insights into currency- and entity-level hedge results. Leveraging advanced exposure aggregation tools and dashboards can drastically reduce time spent on data analysis while enabling fast, accurate reporting for executive stakeholders. Streamline exposure tracking by integrating ERP and treasury systems to automate data aggregation from local business levels. This enables precise, objective-aligned hedging decisions.

Cost management

It often makes sense to reassess which currencies present the greatest risk and designate those for hedging, rather than attempting to eliminate every risk. Consider the cost-effectiveness of instruments, such as forward contracts, options, or more specialized tools like knock-ins/knock-outs, tailoring the choice to market conditions and specific scenarios. Additionally, reviewing the tenor and horizon of hedges can reduce costs in a dynamic environment. Managing operational costs, including personnel, systems, and work hours, is equally critical to efficiency.

Automated reporting

Adopt automated dashboards to provide insight into hedge efficacy, costs, counterparty exposures, and mark-to-market (MTM) values. These reports simplify communication with stakeholders and facilitate post-trade processes like hedge accounting.

6. What other market-driven opportunities should we explore?

In markets with significant variance between USD and non-USD interest rates, companies will often look to cross-currency swaps as an alternate strategy for reducing currency exposure. By synthetically converting U.S. dollar debt to non-U.S.-denominated debt, a company can also reduce interest expense. Additionally, it can provide an opportunity to “re-coupon” existing transactions at a more attractive FX spot rate while solidifying current asset positions. While these transactions can have significant benefits, the economic and accounting considerations are best reviewed with an independent advisor and fiduciary who can provide the expertise required for you to make the best decision for your company.

Moving forward

When considering the volatility in FX markets, it is important to revisit your company's risk management strategy. Chatham's advisory team can partner with you to design and execute a best-in-class hedging strategy based on your economic and accounting objectives. Talk to your relationship manager or contact Chatham to learn more.

Disclaimers

Chatham Hedging Advisors, LLC (CHA) is a subsidiary of Chatham Financial Corp. and provides hedge advisory, accounting and execution services related to swap transactions in the United States. CHA is registered with the Commodity Futures Trading Commission (CFTC) as a commodity trading advisor and is a member of the National Futures Association (NFA); however, neither the CFTC nor the NFA have passed upon the merits of participating in any advisory services offered by CHA. For further information, please visit chathamfinancial.com/legal-notices.

25-0038